What are Opportunity Zones?

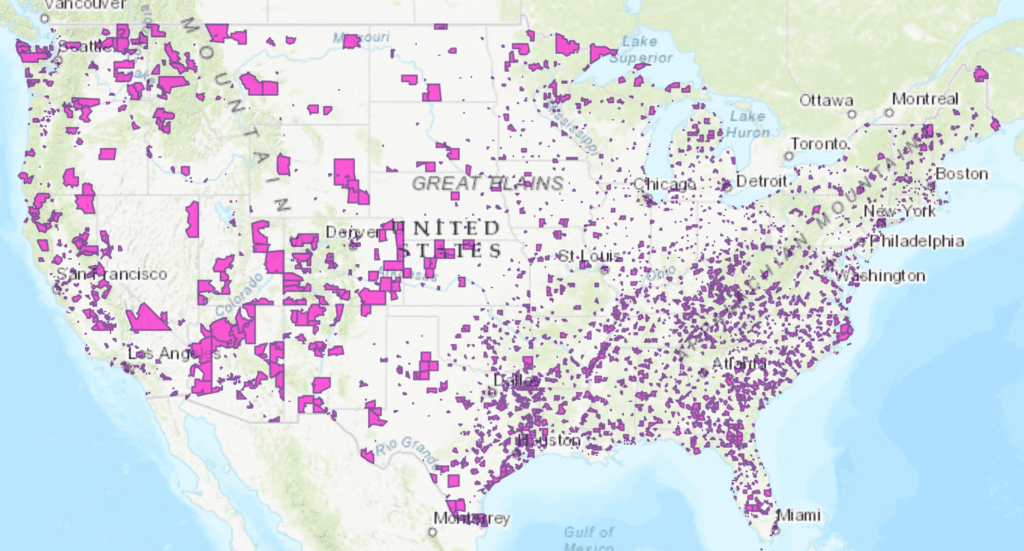

“Opportunity Zones” is a new tax incentive, created through the Tax Cuts and Jobs Act of 2017, to encourage long-term investments in low-income communities across the United States—including Indian Country. There are 8,764 Opportunity Zones in the United States, with approximately 3,500 located in rural zip codes—many of which have experienced a lack of investment for decades. The Opportunity Zones initiative is not a top-down government program, but an incentive to spur private and public investment in America’s underserved communities. Opportunity Zones provide an incentive for investors to receive a tax deferral by re-investing their unrealized capital gains into what are known as Opportunity Funds.

Opportunity Zones Resources:

- Tribal Economic Development Principles-at-a-Glance Series Opportunity Zones in Indian Country

- Opportunity Zones Best Practices Report to the President from The White House Opportunity and Revitalization Council

- Opportunity Zones Frequently Asked Questions

- Economic Development Administration OZ Website

- Opportunity Zones Toolkit Volume 2: A Guide to Local Best Practices and Case Studies

USET SPF Resolution